Política de Transparencia y Ética Empresarial (PTEE)

En el entorno colombiano y a nivel global se han presentado riesgos de corrupción, soborno y soborno transnacional los cuales pueden exponer a las empresas a relaciones ilícitas que no se puedan controlar, por ello, las compañías han optado por generar un programa que permita mantener la identificación, medición, control y monitoreo por las empresas por medio de herramientas de anticorrupción y auditoria con la prioridad de que estos riesgos no se materialicen, toda vez que dichos riesgos pueden generar perjuicios reputacionales, financieros, legales, entre otros.

La corrupción y una de sus manifestaciones más frecuentes de la actualidad, el Soborno, socavan la economía de los países, afectando no solo su desempeño sino también, de manera preponderante, su reputación, a través de la pérdida de confianza de la comunidad en la actuación de uno de sus actores más sobresalientes: las personas jurídicas que persiguen un legítimo ánimo de lucro.

Estas situaciones han llevado a organismos multilaterales como la OCDE “Organización para la Cooperación y el Desarrollo Económico” y los gobiernos nacionales en cabeza de sus órganos de control, a movilizarse hacia la creación de entornos legales que orienten, motiven y finalmente regulen a las personas, tanto naturales como jurídicas, en el desarrollo ético de sus transacciones transfronterizas y sus relaciones con las entidades públicas.

La Superintendencia de Sociedades ha realizado un trabajo arduo para el control y seguimiento con el fin de que las compañías no sean usadas como medio para la realización de los ilícitos de corrupción, soborno y soborno transnacional, que puedan afectar la economía colombiana.

Debido a lo anterior y en aras de establecer unas directrices para prevenir la materialización de los riesgos C/ST, la Superintendencia expidió la Circular Externa N° 100 – 000011 del 9 de agosto de 2021 y la ley 2195 del 18 de enero de 2022.

Con este programa se busca implementar una cultura organizacional, velando por el cumplimiento de las políticas, procedimientos y directrices establecidas para el control de los riesgos C/ST.

Las contrapartes definidas por la compañía se comprometen con el cumplimiento del programada de transparencia y ética empresarial.

De acuerdo a lo establecido por la Circular 100-000011 del 9 de agosto de 2021 y Ley 2195 del 18 de enero de 2022, se define el Programa de Transparencia y Ética Empresarial en donde se describe las actividades con las que la compañía implementa los controles para la prevención del riesgo de soborno transnacional, corrupción y prácticas corruptas con base en los lineamientos establecidos en el código de ética y las políticas definidas por ARANDA SOFTWARE ANDINA S.A.S., en adelante ARANDA SOFTWARE.

Establecer las políticas y procedimientos a través de los cuales ARANDA SOFTWARE determina su actuar ético y transparente en el ejercicio de su actividad y su negocio, determinando las condiciones bajo las cuales se podrá identificar, detectar, prevenir y mitigar los riesgos relacionados con el soborno, soborno transnacional y la corrupción.

El presente Manual es un instrumento para que todos los empleados de ARANDA SOFTWARE lo utilicen en el oportuno desempeño de sus funciones, facilitando el autocontrol y ejecución de los procesos, permitiendo identificar preventivamente las diferentes situaciones de riesgo de Corrupción y Soborno Transnacional a las que se pueda ver expuesta la empresa.

De igual manera, el presente manual busca definir las metodologías, procedimientos y responsabilidades que se deben tener en cuenta en la operación, en lo referente a las exposiciones al riesgo de Corrupción y Soborno Transnacional, así como en sus diferentes etapas y los límites de exposición.

Para un mejor entendimiento del presente manual se relacionan a continuación las principales definiciones que fueron tomadas como referencia de las establecidas en la ley y las diferentes normatividades que se relacionan con los riesgos de Corrupción y Soborno Transnacional, tales como:

- Ley 222 de 1995

- Ley 1778 del 2016

- Circular Externa 100-000011 del 2021 (Capitulo XIII de la Circular Básica Jurídica de la Superintendencia de Sociedades)

- Ley 2195 del 2022

Actividad Ilícita: Es la revisión sistemática, crítica y periódica respecto de la debida ejecución del Programa de Transparencia y Ética Empresarial.

Anticipo: porcentaje pactado del valor total del contrato que se le cancela al contratista una vez perfeccionado y cumplidos los requisitos previamente establecidos en el mismo, el cual será pagado antes de su iniciación o durante su desarrollo.

Asociados: aquellas personas naturales o jurídicas que han realizado un aporte en dinero, en trabajo o en otros bienes apreciables en dinero a ARANDA SOFTWARE a cambio de cuotas, partes de interés, acciones o cualquier otra forma de participación que contemplen las leyes colombianas.

Auditoría de cumplimiento: es la revisión sistemática, crítica y periódica respecto de la debida ejecución del Programa de Transparencia y Ética Empresarial.

Beneficiario final: entiéndase por beneficiario final la(s) persona(s) natural(es) que finalmente posee(n) o controla(n) directa o indirectamente a un cliente y/o la persona natural en cuyo nombre se realiza una transacción, incluye también las personas que ejerzan el control efectivo y/o final directa o indirectamente, sobre una persona jurídica u otra estructura sin personería jurídica.

Capítulo XIII: hace referencia al Capítulo XIII de la Circular Básica Jurídica de la Superintendencia de Sociedades, en el que se incluyen instrucciones administrativas y recomendaciones para la adopción del PTEE.

Conflicto de interés: situación en virtud de la cual una persona, en razón de su actividad, se enfrenta a distintas alternativas de conducta con relación a intereses incompatibles, ninguno de los cuales se puede privilegiar en atención a las obligaciones legales o contractuales.

Contratista: se refiere, en el contexto de un negocio o transacción internacional, a cualquier tercero que preste servicios a ARANDA SOFTWARE o que tenga con ésta una relación jurídica contractual de cualquier naturaleza.

Corrupción: se refiere al mal uso de las facultades derivadas de una relación de autoridad o confianza para la obtención de una ventaja indebida, tanto en el sector público como en el privado.

Debida diligencia: revisión periódica que ha de hacerse sobre los aspectos legales, contables y financieros relacionados con un negocio o transacción internacional, cuyo propósito es el de identificar y evaluar los riesgos de soborno transnacional, soborno nacional y corrupción que pueden afectar o involucrar a ARANDA SOFTWARE y a los contratistas.

Desleal: deslealtad, traición o quebrantamiento de la fe debida.

Empleado: es el individuo que se obliga a través de un contrato laboral a prestar un servicio personal bajo subordinación de ARANDA SOFTWARE, a cambio de una remuneración.

Empresa: es la sociedad comercial, empresa unipersonal o sucursal de sociedad extranjera supervisada por la Superintendencia de Sociedades, conforme a los artículos 83, 84 y 85 de la Ley 222 de 1995.

Extorsión: acción de constreñir a otro a hacer, tolerar u omitir alguna cosa, con el propósito de obtener provecho ilícito o cualquier utilidad o beneficio ilícita, para sí o para un tercero.

Gestión de riesgos de soborno transnacional y corrupción: se refiere al proceso de identificación, análisis, evaluación y tratamiento de los riesgos de soborno y corrupción o cualquier otra práctica corrupta, definido en HRC-PR-01 – Procedimiento de gestión y control del riesgo.

Ley 1474: es la Ley 1474 del 12 de julio de 2011, por la cual se dictan normas orientadas a fortalecer los mecanismos de prevención, investigación y sanción de actos de corrupción y la efectividad del control de la gestión pública y se establece como delito penal la corrupción privada y la administración desleal.

Ley 1778: es la Ley 1778 del 2 de febrero de 2016, por la cual se dictan normas sobre la responsabilidad de las personas jurídicas por actos de corrupción transnacional y se dictan otras disposiciones en materia de lucha contra la corrupción. Además, en su artículo establece el deber en cabeza de la Superintendencia de Sociedades de promover en las sociedades sujetas a us vigilancia, la adopción de programas de transparencia y ética empresarial, de mecanismos internos anticorrupción, de mecanismos y normas internas de auditoría, promoción de la transparencia y mecanismos de prevención de las conductas de Soborno Transnacional.

Ley 2195: es la Ley 2195 del 18 de enero de 2022 “Ley Anticorrupción”, por medio de la cual se adoptan medidas en materia de transparencia, prevención y lucha contra la corrupción y se dictan otras disposiciones.

Matriz de riesgo: es la herramienta que le permite a la Entidad identificar los Riesgos de Corrupción o los Riesgos de Soborno Transnacional.

OCDE: es la organización para la Cooperación y el Desarrollo Económico.

Oficial de Cumplimiento de Ética: es la persona natural designada por la Asamblea General para liderar y administrar el Programa de Transparencia y Ética Empresarial de ARANDA SOFTWARE.

Persona Expuesta Políticamente o PEP: corresponde a la definición establecida en el artículo 2.1.4.2.3 del Decreto 1081 de 2015, modificado por el artículo 2° del Decreto 830 del 26 de julio de 2021.

Políticas de cumplimiento: son las políticas generales que adopta la entidad para llevar a cabo sus negocios y operaciones de manera ética, transparente y honesta; y esté en condiciones de identificar, detectar, prevenir y atenuar los Riesgos de Corrupción o Riesgos de Soborno Transnacional.

Práctica corrupta: consiste en ofrecer, dar, recibir o solicitar, directa o indirectamente, cualquier cosa de valor para influenciar indebidamente las acciones de otra parte o para beneficio propio.

Programa de Transparencia y Ética Empresarial o PTEE: es el documento que recoge la política de Cumplimiento y los procedimientos específicos a cargo del Oficial de Cumplimiento de ética, encaminados a poner en funcionamiento la Política de Cumplimiento, con el fin de identificar, detectar, prevenir, gestionar y mitigar los Riesgos de Corrupción o los Riesgos de Soborno Transnacional que puedan afectar a la entidad, conforme a la Matriz de Riesgo, y demás instrucciones y recomendaciones establecidas por la Superintendencia de Sociedades.

Servidor público extranjero: es lo establecido en el parágrafo 1° del artículo 2° de la Ley 1778.

Soborno: es el acto de dar, ofrecer, prometer, solicitar o recibir cualquier dádiva o cosa de valor a cambio de un beneficio o cualquier otra contraprestación, o a cambio de realizar u omitir un acto inherente a una función pública o privada, con independencia de que la oferta, promesa, o solicitud es para uno mismo o para un tercero, o en nombre de esa persona o en nombre de un tercero.

Soborno transnacional: es el acto en virtud del cual, la empresa, por medio de sus empleados, administradores, asociados o contratistas, da, ofrece o promete a un servidor público extranjero, de manera directa o indirecta:

(i) Sumas de dinero.

(ii) Objetos de valor pecuniario.

(iii) Cualquier beneficio o utilidad a cambio de que ese servidor público realice, omita o retarde cualquier acto relacionado con sus funciones y en relación con un negocio o transacción internacional.

Tipologías: es un estudio que analiza fenómenos, sectores, tendencias o modalidades por las cuales se realizan actos de corrupción, operaciones de lavado de activos y financiación del terrorismo, las tipologías no tienen una relación directa con el desarrollo de los procesos de investigación penal, disciplinaria y fiscal, por cuanto apuntan a la comprensión del modus operandi utilizado por los actores involucrados y no a su posterior resolución ante las instancias competentes.

ARANDA SOFTWARE enmarca su gestión corporativa en el cumplimiento de seis (6) principios fundamentales del PTEE, buscando generar un valor agregado a las partes interesadas, siempre que todas las actividades desarrolladas cumplan con el marco normativo y las buenas prácticas relacionadas con el buen gobierno corporativo y la administración de riesgos establecidas por las autoridades colombianas y los entes extranjeros calificados.

La alta Gerencia reconoce que ARANDA SOFTWARE es propensa al riesgo de Corrupción y Soborno Transnacional por lo cual se compromete a desarrollar actividades tendientes a crear una cultura de gestión del riesgo apoyando a la entidad en todas las etapas del PTEE y brindando las herramientas necesarias de acuerdo con el tamaño y naturaleza de la empresa.

En este marco se definen los siguientes principios del PTEE:

6.1. Tolerancia cero a Prácticas Corruptas

ARANDA SOFTWARE no tolera el soborno y la corrupción, ni cualquier otra conducta que atente contra la ética y la transparencia de los negocios y sus actividades. Por lo tanto, ni la entidad ni sus contrapartes tendrán la intención de participar, directa o indirectamente, en prácticas fraudulentas de soborno y corrupción, y sancionará drásticamente a cualquier persona que incurra en dichas prácticas.

6.2. Honestidad

En medida de que todos los trabajadores sean conscientes de sus responsabilidades y de sus obligaciones laborales, éticas y legales, podrá darse cumplimiento a los deberes existentes de la sociedad, la empresa, la comunidad y el país. Lo anterior requerirá que las actividades comerciales y empresariales desarrolladas por la compañía se rijan por estándares de honestidad y legitimidad.

6.3. Transparencia

Este principio busca que las actuaciones se realicen con buena fe, diligencia y cuidado profesional, velando permanentemente por el respeto de las personas y el cumplimiento de la ley, dando prioridad en sus decisiones a los principios y valores de la compañía por encima del interés particular evitando cualquier tipo de conflicto de interés.

Todas las acciones siempre deben estar regidas por el interés general y la gestión a todo nivel debe estar desprovista de cualquier interés económico o beneficio personal. Las conductas transparentes están exentas de pagos o reconocimientos para obtener o retener negocios.

6.4. Lealtad

Sin perjuicio de los procedimientos establecidos en ARANDA SOFTWARE, todos los miembros del máximo órgano social u órganos equivalentes, asociados, administradores, colaboradores, proveedores, contratistas y terceros en general, así como cualquier persona que tenga conocimiento de una conducta que constituya soborno transnacional o cualquier práctica corrupta relacionada con la compañía, deberán reportar de forma inmediata tales infracciones al Oficial de Cumplimiento de Ética mediante los canales de comunicación establecidos. Para tal efecto, se reservarán bajo confidencialidad los datos de la persona que haya dado aviso sobre tales conductas y se seguirán los canales establecidos en el presenta Manual de Cumplimiento del PTEE.

6.5. Legalidad

Todas las personas vinculadas a la compañía están comprometidas en velar por el cumplimiento de la constitución y de las leyes colombianas, como también, de las disposiciones y reglamentaciones que expidan las autoridades, las normas y políticas fijadas por la Compañía.

6.6. Proporcionalidad

Todas las actuaciones, actividades y operaciones que realice cualquiera de las contrapartes de la entidad, deben realizarse de manera proporcional evitando actos desmedidos en cualquiera de las situaciones que enfrenten a todo nivel (relaciones, operaciones, descuentos, gastos, cortesías, donaciones, regalos, entre otros) que impliquen beneficios económicos o que generen valor para la contraparte, la compañía o terceros.

7.1. Responsabilidades

Sin perjuicio de las funciones asignadas en las demás Políticas de Cumplimiento, para efectos del presente Programa, la Asamblea de Accionistas, tendrá las siguientes funciones:

- Asegurar el suministro de los recursos económicos, humanos y tecnológicos que requiera el Oficial de Cumplimiento de Ética para el desarrollo del Programa de Transparencia y Ética Empresarial y los procedimientos relacionados que apliquen.

- Ordenar las acciones disciplinarias, administrativas y legales a que haya lugar, contra los empleados que tengan funciones de dirección y administración o contra los socios, cuando infrinjan lo previsto en el Programa de Transparencia y Ética Empresarial.

- Evaluar, realizar seguimiento y si es necesario requerir ajustes o modificaciones al Programa de Transparencia y ética empresarial.

- Liderar una estrategia de comunicación adecuada para garantizar la divulgación eficaz de la Política Antisoborno y Anticorrupción y del Programa de Transparencia y Ética Empresarial para los empleados, socios, proveedores y contratistas y la ciudadanía en general.

- Aprobar el documento que contemple el PTEE.

- Asumir un compromiso dirigido a la prevención de los riesgos de Corrupción y Soborno Transnacional, de forma tal que ARANDA SOFTWARE pueda llevar a cabo sus negocios de manera ética, transparente y honesta.

7.1.2. Representante Legal

Para el funcionamiento del PTEE se requiere como mínimo que el Representante Legal o quien haga sus veces, ejecute las siguientes funciones:

- Presentar con el Oficial de Cumplimiento de Ética, para aprobación de la Asamblea de Accionistas, la propuesta del PTEE.

- Velar porque el PTEE se articule con las Políticas de Cumplimiento adoptadas por la Asamblea de Accionistas.

- Prestar efectivo, eficiente y oportuno apoyo al Oficial de Cumplimiento de Ética en el diseño, dirección, supervisión y monitoreo del PTEE.

- Asegurar que las actividades que resulten del desarrollo del PTEE se encuentren debidamente documentadas, de modo que se permita que la información responda a unos criterios de integridad, confiabilidad, disponibilidad, cumplimiento, efectividad, eficiencia y confidencialidad.

- El representante legal propondrá la persona que ocupará la función de Oficial de Cumplimiento de Ética, para la designación por parte de la Asamblea de Accionistas.

7.1.3 Oficial de Cumplimiento de Ética

El Oficial de Cumplimiento de Ética es el responsable de la ejecución y seguimiento del Sistema de Gestión de Riesgos de Corrupción y Soborno Transnacional. Para el efecto, deberá desarrollar las siguientes funciones:

- Articular las políticas de cumplimiento con el Programa de Transparencia y Ética Empresarial.

- Presentar a la Asamblea informes de su gestión como Oficial de Cumplimiento de Ética, de forma anual, de acuerdo con lo definido en el numeral 6.1.8.13. Informes.

- Liderar la estructuración del Programa de Transparencia y Ética Empresarial, contenido en este Manual.

- Dirigir las actividades periódicas de evaluación de los riesgos de soborno y corrupción.

- Informar a la Asamblea acerca de las infracciones que haya cometido cualquier empleado respecto del Programa de Transparencia y Ética Empresarial, para que se adelanten los correspondientes procedimientos sancionatorios conforme lo establezca el Código de Ética y el Reglamento Interno de Trabajo.

- Seleccionar y facilitar la capacitación constante de los empleados en la prevención del soborno transnacional, durante los procesos de inducción y reinducción, de acuerdo con lo definido en el numeral 6.1.8.14 Divulgación y Capacitación.

- Dirigir el sistema que ponga en marcha la empresa para recibir denuncias de cualquier persona respecto de un caso de soborno o de cualquier otra práctica corrupta.

- Ordenar el inicio de procesos internos de investigación, mediante la utilización de recursos humanos y tecnológicos propios o través de terceros especializados en estas materias, cuando tenga sospechas de que se ha cometido una infracción a la Ley 1778 de 2016, Ley 2195 de 2022 o al Programa de Transparencia y Ética Empresarial.

7.1.4 Empleados

El principal deber del Empleado de ARANDA SOFTWARE es el de mantener un estricto compromiso con la política de control y prevención de los riesgos en general y en particular de las conductas asociadas a la Corrupción y el Soborno Transnacional fijada por la empresa, el cual se reflejará en el cumplimiento de los siguientes deberes:

- Aplicar y cumplir lo definido en el Manual de Transparencia y Ética Empresarial y en las disposiciones normativas en las que este se fundamenta.

- Denunciar cualquier acto de soborno y/o corrupción al interior de ARANDA SOFTWARE, a través de los canales dispuestos por la empresa, así como cooperar en las investigaciones que se adelanten.

- Participar en las capacitaciones (inducción y reinducción) sobre el Programa de Transparencia y Ética Empresarial, a las que sea convocado.

- Para los empleados que participan en el proceso de contratación de proveedores y en la vinculación de empleados directos o indirectos, verificar que la documentación aportada esté completa y concuerde con la información registrada en el formulario de conocimiento de proveedores, asegurar que se realice la consulta en listas vinculantes y restrictivas y que en los acuerdos contractuales se incorporen las cláusulas antisoborno y anticorrupción. Esto es, de acuerdo con los procedimientos internos.

7.1.5 Contrapartes en General

Todas las Contrapartes de la Compañía estarán obligadas a cumplir las funciones contenidas en el presente Manual, incluyendo las siguientes, sin perjuicio de que algunas de las mismas correspondan también a otros órganos o empleados de la propia Compañía:

- Asumir en todo momento una actitud transparente frente a las demás Contrapartes.

- No ofrecer a las demás Contrapartes, ni recibir por parte de ellas, ventajas tendientes a modificar los procedimientos internos a favor de cualquiera de las Contrapartes.

- Mostrar un comportamiento ajustado a la ley en el desarrollo de sus labores.

- Rechazar y no fomentar actos de Corrupción o Soborno alguno frente a todas las Contrapartes con las que interactúe.

- Tener un comportamiento ético y transparente en el manejo de los recursos humanos, financieros y tecnológicos de la Compañía.

- Cumplir con la normativa interna establecida para la contratación y para la adquisición de bienes y servicios.

- No ocultar ninguna actividad relacionada con actos de Corrupción o Soborno.

7.1.6 Revisor Fiscal

Con la expedición de la Ley 1778 de 2016, al Revisor Fiscal se le confirieron facultades de veeduría que sobrepasan aquellas de representación de los intereses de los socios frente a las operaciones que se celebren o ejecuten en la Empresa. En efecto, de acuerdo con los mandatos del artículo 32 de la citada Ley, los Revisores Fiscales adquieren la obligación de denunciar ante las autoridades penales, disciplinarias y administrativas, los posibles actos de soborno y corrupción que hubieren detectado en el ejercicio de su cargo.

7.1.7 Política Antisoborno – Anticorrupción

ARANDA SOFTWARE cuenta con condiciones establecidas para mitigar y controlar el soborno y la corrupción definiendo la HRC-PL-01 – Política antisoborno para gestión del riesgo y Cumplimiento, en donde se compromete con lineamientos establecidos para mitigar el soborno, soborno transnacional y la corrupción.

7.1.8 Gestión de Riesgos

ARANDA SOFTWARE define el HRC-PR-01 – Procedimiento de Gestión y control del Riesgo y la HRC-FT-01 – Matriz de Gestión del Riesgo cuyo alcance incluye la identificación, análisis, evaluación y tratamiento de los riesgos de la compañía, abordando el soborno, corrupción, soborno transnacional y cualquier otra práctica corrupta, así mismo, la compañía define la HRC-PL-01 – Política Antisoborno para la Gestión del Riesgo y Cumplimiento en donde se compromete con la gestión del riesgo mediante herramientas estandarizadas y controladas.

7.1.9 Debida Diligencia

Contrapartes: ARANDA SOFTWARE integra y estandariza medidas de control para la identificación y conocimiento de las personas naturales o jurídicas previo a establecer una relación jurídica contractual de cualquier naturaleza, por esta razón en el HRC-PR-02 – Procedimiento de debida diligencia describe el paso a paso para conocer y actualizar los datos de sus contrapartes, de esta misma manera para validar sus antecedentes y reputación en general.

Cambios de composición accionaria: El conocimiento de personas jurídicas hace parte integral de la identificación y control de los miembros de la compañía, por tal motivo se debe aplicar el proceso de la debida diligencia con las que se pretenda adelantar cualquier tipo de proceso de reorganización empresarial como fusiones o adquisiciones, ver HRC-PR-02 – Procedimiento de debida diligencia.

Nuevas líneas de negocio o proyectos: en cada proceso de negociación y análisis de inversión, se realizará una debida diligencia sobre el cumplimiento de reglas antisoborno y anticorrupción, antes de tomar una decisión final sobre la inversión o la fusión. Así mismo, en caso de concretarse la adquisición

o la fusión, ARANDA SOFTWARE se asegurará de que la empresa adquirida implemente, dentro de un plazo razonable, el presente Programa de Transparencia y Ética Empresarial.

La Debida Diligencia que realice ARANDA SOFTWARE está orientada principalmente a suministrarle elementos necesarios para identificar y evaluar los riesgos de Corrupción y Soborno Transnacional, que puedan afectar operaciones, transacciones y contratos internacionales o contratos nacionales catalogados de alto riesgo con (i) entidades privadas del orden internacional y nacional, (ii) intermediarios nacionales e internacionales (subcontratistas, comisionistas, agentes de servicio, agentes comerciales, corredores, etc.) que en virtud de la ejecución de un contrato, de un trámite, una licencia o un pago (incluye pagos de impuestos, aranceles, multas, etc.) realizado ante cualquier entidad pública nacional (del orden nacional, departamental y municipal) e internacional, participa en dichas operaciones (iii) terceros beneficiarios de donaciones, patrocinios y contribuciones políticas.

Las actividades de debida diligencia deberán constar por escrito, de forma tal que pueda ser de fácil acceso y entendimiento para el Oficial de Cumplimiento de Ética.

En caso comprobado de un hallazgo en el proceso de debida diligencia de un tercero que haya sido condenado por delitos de Soborno y/o Corrupción, la empresa no podrá tener vínculo alguno con ese tercero. En caso de dudas sobre los hallazgos, el área interesada debe dirigirse al Oficial de Cumplimiento de Ética para aclararlas.

7.1.10 Política de contratos con entidades públicas nacionales o internacionales

En los casos de contratos en donde los terceros sean entidades públicas nacionales y/o internacionales, la parte responsable del negocio deberá tener especial atención a lo dispuesto en el Programa de Transparencia y Ética Empresarial para orientar la conducta que se debe tener por parte de los empleados o terceros (socios, proveedores, subcontratistas, comisionistas, agentes de servicio, agentes comerciales, corredores, etc.) en el posible relacionamiento con servidores públicos de entidades estatales dando estricto cumplimiento de las políticas y principios establecidos en el presente Manual. Debe surtírsele una evaluación de las operaciones y transacciones que giran en torno a los contratos celebrados con entidades públicas nacionales e internacionales.

El Oficial de Cumplimiento de Ética tendrá la facultad de auditar este tipo de relacionamiento de manera aleatoria dentro de la empresa con el fin de realizar una evaluación particular para encontrar hallazgos que permitan tomar medidas para prevenir los riesgos de Soborno y Corrupción.

7.1.11 Política de trámites o pagos ante las entidades públicas nacionales e internacionales

Intermediarios nacionales e internacionales (subcontratistas, comisionistas, agentes de servicio, agentes comerciales, corredores, etc.) que, en virtud de la ejecución de un contrato, de un trámite, una licencia o un pago (incluye pagos de impuestos, aranceles, multas, etc.) realizado ante cualquier entidad pública nacional (del orden nacional, departamental y municipal) e internacional, participa en dichas operaciones.

En los casos en que se deban realizar trámites, expedición de licencias, pagos (incluye pagos de impuestos, aranceles, multas, etc.) ante las entidades públicas (del orden nacional, departamental y municipal) o internacionales, la parte responsable del negocio u operación deberá tener especial atención a lo dispuesto en el Programa de Transparencia y Ética Empresarial para orientar la conducta que se debe tener por parte de los empleados, socios, proveedores, contratistas, subcontratistas y terceros en general en el posible relacionamiento con servidores públicos de entidades estatales dando estricto cumplimiento de las políticas y principios establecidos en el presente Manual.

El Oficial de Cumplimiento de Ética tendrá la facultad de auditar este tipo de relacionamiento de manera aleatoria dentro de la empresa con el fin de realizar una evaluación particular para encontrar hallazgos que permitan tomar medidas para prevenir los riesgos de Soborno y Corrupción.

7.1.12 En la vinculación de contrapartes privadas nacionales y extranjeras

En los casos en que se requiera hacer debida diligencia de terceros tales como socios, clientes, proveedores, contratistas, beneficiarios y terceros en general, fuera de realizar los procesos de vinculación establecidos por la entidad en el Programa de Transparencia y Ética Empresarial – PTEE, ARANDA SOFTWARE revisará los aspectos legales (sanciones administrativas, penales y disciplinarios), antecedentes comerciales y reputacionales, aspectos contables y financieros; y posibles malas prácticas de dichas contrapartes.

Para la vinculación de cualquier tercero del sector privado con el que se realicen transacciones nacionales o extranjeras, debe surtírsele una debida diligencia por parte del área interesada en el negocio a la contraparte y demás personas que intervienen en el relacionamiento en calidad de intermediarios (subcontratistas, comisionistas, agentes de servicio, agentes comerciales, corredores, etc.).

En caso de hallazgo en el proceso de Debida Diligencia de un tercero condenado por delitos de Soborno y/o Corrupción, la empresa no podrá tener vínculo alguno con dicho tercero. En caso de dudas sobre los hallazgos, el área interesada debe dirigirse al Oficial de Cumplimiento de Ética para aclararlas.

Para dar cumplimiento a las políticas definidas en el presente numeral se deberán realizar los procedimientos establecidos en el documento HRC-PR-02- procedimiento de debida diligencia.

El Oficial de Cumplimiento de Ética tendrá la facultad de auditar este tipo de relacionamiento de manera aleatoria dentro de la empresa con el fin de realizar una evaluación particular para encontrar hallazgos que permitan tomar medidas para prevenir los riesgos de Soborno y Corrupción.

7.1.13 Contrapartes a las que no se les hará debida diligencia

ARANDA SOFTWARE, define que no realizará debida diligencia a las contrapartes como: Alcaldías, Gobernaciones, Prestadores de Servicios Públicos, Personería, Empresas de venta de Combustible, Líneas navieras, Restaurantes, Almacenes de cadena, Beneficencia y registro, Notarías, Cámaras de Comercio, EPS, Fondo de pensiones, Cesantías, Cajas de compensación, Administraciones de Copropiedades, Entidades Financieras, Entidades Gubernamentales de Vigilancia y Control, Aseguradoras, Empresas que coticen en Bolsa de Valores; pues entendido el propósito y la naturaleza a partir del tipo de transacciones o relación comercial establecida con las mismas, consideramos que son personas jurídicas que representan un menor riesgo de Corrupción y/o Soborno Transnacional para la compañía toda vez que en su mayoría están vigiladas por una Superintendencia y además para el desarrollo de nuestra actividad se requiere de los servicios que nos prestan, principalmente aquellas que hacen parte del sector público mencionadas anteriormente.

7.1.14 Políticas de contratos o acuerdos con terceras personas.

Todos los contratos o acuerdos suscritos por la Compañía deben contener cláusulas, declaraciones o garantías sobre conductas anti-soborno y anti-corrupción en temas de cumplimiento, actuación, auditoría y terminación unilateral por incurrir en conductas de corrupción o soborno transnacional. La Dirección Jurídica debe ser la responsable de incluir dichas cláusulas en todos los contratos.

En aquellos casos en los que en el contrato no consten por escrito estos compromisos, se podrá realizar un documento que contenga las disposiciones establecidas para el cumplimiento del manual de PTEE, mediante el documento denominado “Disclosure Letter” (Carta de Divulgación) en el cual, el proveedor o contratista declara el cumplimiento del manual de PTEE y la inexistencia de investigaciones por posibles violaciones a las disposiciones anti-soborno y anti-corrupción que puedan afectar la ejecución del contrato a celebrar, y el estado de las mismas.

Los terceros que actúan a nombre de la empresa frente a funcionarios públicos o privados deberán conocer y dar cumplimiento de este Programa y se comprometerán contractualmente a no realizar ningún acto de corrupción y permitirán que ARANDA SOFTWARE monitoree o audite sus actuaciones en Colombia y en el exterior.

Los Contratistas que actúan a nombre de la empresa frente a funcionarios Públicos o privados deberán conocer y comprometerse a dar cumplimiento de este Programa y se comprometerán en sus contratos

a no realizar ningún Acto de Corrupción y a permitir que la Compañía monitoree o audite sus actuaciones en Colombia y en el exterior.

7.1.15 Política con Operaciones en países con índices de corrupción elevadas

Cuando existan contrapartes ubicadas en países con índices de corrupción elevados, estas podrían ser catalogados como contrapartes de alto riesgo de acuerdo con los informes que publique Transparencia Internacional. El Oficial de Cumplimiento de Ética realizará de manera aleatoria verificaciones de las debidas diligencias realizadas con dichos terceros que se encuentren en dichos países con el fin de evaluar si la contraparte se encuentra calificada de acuerdo con su adecuado nivel de riesgo, de lo contrario el Oficial de Cumplimiento de Ética podrá cambiar su calificación de acuerdo con su juicio profesional atendiendo los principios de prudencia y cuidado profesional. De ser necesario, propondrá nuevos controles específicos a dichas contrapartes.

7.1.16 Política de pagos a terceros (remuneraciones y comisiones)

Todo pago o desembolso de los recursos de ARANDA SOFTWARE dirigido a sus proveedores, contratistas e intermediarios, sean nacionales o del exterior, deberán realizarse mediante canales bancarios en los que sea posible rastrear todos los movimientos y pagos, por lo tanto, está prohibido realizar este tipo de pagos en efectivo.

Todos los pagos realizados a los proveedores, contratistas e intermediarios deberán estar soportados y documentados por los valores estipulados en los diferentes documentos contractuales (contratos, órdenes de compra, órdenes de servicio, entre otros), y podrán ser auditados por parte de los entes de control internos y externos. Estas auditorias deberán estar encaminadas a confirmar la legalidad de los pagos, la no desviación de recursos, y el no encubrimiento de pagos a terceros sin justificación documental.

Los pagos de facilitación (Pagos dados a un funcionario público, persona de negocios o tercero en general para agilizar un trámite u obtener cualquier beneficio), están prohibidos para cualquier miembro de la asamblea de accionistas, asociado, administrador, colaboradores, proveedor, contratista y terceros en general. Dichos pagos no deben hacerse a funcionarios públicos, ni siquiera si son una práctica común en un país determinado.

Ningún empleado está autorizado a ordenar pagos desde la Compañía que no estén relacionados directamente con las obligaciones legales, contractuales o necesidades de la Empresa, que no sean soportados de manera adecuada o que no le corresponda ordenar, en cuyo caso está excediendo su límite de autoridad. Estos desembolsos incluyen las operaciones que son realizadas a través de la caja

menor. Tampoco podrá percibir pagos a favor de la Compañía cuando en el desarrollo de sus funciones el recibo de pagos no le ha sido autorizado.

7.1.17 Política ante fusiones y adquisiciones

ARANDA SOFTWARE no se fusionará con, ni adquirirá participación en compañías que hayan sido condenadas por actos de corrupción o soborno transnacional. Para lo anterior, el Oficial de Cumplimiento de Ética deberá ser integrado ante cualquier operación de esta naturaleza para que realice la debida diligencia con el fin que dicha transacción no contenga ningún riesgo por actos de corrupción o soborno transnacional.

7.1.18 Política de Registros Contables

La Compañía debe llevar y mantener registros y cuentas que reflejen de forma exacta y precisa todas las transacciones realizadas. Los Empleados de la Compañía no pueden cambiar, omitir o tergiversar registros para ocultar actividades indebidas o que no indican correctamente la realidad ni la naturaleza de una transacción registrada.

La Compañía tiene controles internos para prevenir que se oculten o disimulen sobornos u otros pagos indebidos en transacciones como: comisiones, pagos de honorarios, patrocinios, donaciones, gastos de representación o cualquier otro rubro que sirva para ocultar o encubrir la naturaleza impropia del pago originado por acciones de soborno o corrupción.

El área Financiera verificará que la causación de toda cuenta por pagar esté soportada con una factura o documento equivalente y sus anexos. A los bienes o servicios recibidos que no cuenten con un soporte válido, no se les autorizará su pago hasta tanto no se reciba el respectivo soporte.

7.1.19 Política de comportamientos de los colaboradores frente al Programa de Transparencia y Ética Empresarial – PTEE

Los empleados de ARANDA SOFTWARE desarrollarán sus actividades, dentro del marco del cumplimiento de los principios éticos descritos en el presente documento, el cual debe primar en todas las actividades del negocio sobre las metas operativas, administrativas y comerciales, procurando el mejor desarrollo del objeto social, en un marco de transparencia y cumplimiento estricto de las normas y procedimientos internos y de prevención y monitoreo de los riesgos de Corrupción y Soborno Transnacional.

Es deber de ARANDA SOFTWARE, sus accionistas, sus administradores, su oficial de cumplimiento de Ética y demás empleados vinculados, asegurar el cumplimiento de las normas encaminadas a prevenir

y controlar el riesgo Corrupción y Soborno Transnacional, particularmente, las contenidas en las normas legales, con el propósito no sólo de contribuir a la realización de los fines del Estado y de cumplir la ley, sino de proteger la imagen y la reputación nacional e internacional de la compañía.

En referencia al riesgo de Corrupción y Soborno Transnacional, todos los empleados:

- Deberán conocer y actuar conforme con lo aquí indicado.

- Además de lo contemplado en este documento, es responsabilidad de cada empleado, reportar al Oficial de Cumplimiento de Ética cualquier hecho o situación inusual o sospechosa que le haga suponer que puede presentarse un intento de corrupción y soborno a través de los diferentes canales que ha dispuesto la empresa para tal fin.

- Deberán anteponer el cumplimiento de las normas en materia de prevención de corrupción y soborno, al logro de las metas comerciales, financieras, operativas o administrativas.

- El Oficial de Cumplimiento de Ética deberá brindar todo el apoyo necesario a los empleados que se encuentren frente a una situación de conflicto de interés o de riesgo de participar en una conducta de corrupción o soborno originada en estas actividades comerciales, financieras, operativas o administrativas.

- En todos los casos, los empleados, colaboradores y aliados responsables de la gestión del riesgo de Corrupción y Soborno Transnacional de la organización deben guardar absoluta reserva sobre las actuaciones y/o actividades de investigación o incumplimiento detectadas por la organización. En ningún caso los clientes, empleados, directores o demás partes interesadas podrán ser informadas sobre los reportes realizados en materia de soborno y corrupción en los que hayan sido relacionados.

- No podrán avisar, alertar o dar a conocer a las contrapartes investigadas por posibles actuaciones en hechos de corrupción y soborno. De igual forma la Sociedad deberá guardar reserva respecto a esta información y/o documentación.

7.1.20 Política sobre extorsión

Los accionistas, administradores, colaboradores, proveedores, contratistas y demás terceros deben rechazar cualquier pedido directo o indirecto de sobornos por parte de un servidor público o privado, específicamente en aquellos casos en los que el servidor público o privado extorsione mediante amenazas de omitir, realizar, acelerar o retardar una gestión a su cargo y en relación con un acto, negocio o transacción internacional en el que ARANDA SOFTWARE tenga un interés legítimo.

Es política de la empresa que los asociados, accionistas, administradores, colaboradores, proveedores, contratistas y terceros en general en consideración a su relación jurídica específica con la entidad, no podrán acceder a las extorsiones de servidores públicos o privados, ni realizar los pagos asociados a tal conducta delictiva.

En caso de que estas conductas extorsivas pongan en peligro la seguridad y el bienestar de los asociados, accionistas, administradores, colaboradores, proveedores, contratistas y terceros en general, estos deberán tomar las medidas razonables y legales para salvaguardar su bienestar y seguridad.

En cualquier caso, se debe comunicar inmediatamente al Oficial de Cumplimiento de Ética cualquier situación de este tipo con el fin de que este inicie las actuaciones que correspondan, particularmente para que se informe al representante legal de la Sociedad.

7.1.21 Gestión de Transparencia y Prevención de la Corrupción

7.1.21.1 Transparencia de la información

La información y registros financieros son los insumos fundamentales para el desarrollo de los procesos y la toma de las decisiones acertadas, también permite demostrar el cumplimiento que se tiene con las obligaciones para los empleados, accionistas, clientes, proveedores y autoridades reguladoras. Por esta razón ARANDA SOFTWARE garantiza que todos los registros son veraces, validos, completos, precisos y deben estar acorde a los requerimientos legales, de tal forma que ARANDA SOFTWARE pueda confirmar y recuperar la información de manera transparente.

De acuerdo a lo anterior, la revisoría fiscal realiza verificaciones a los estados y balances financieros, así como a los movimientos contables que se puedan ejecutar, confirmando la veracidad de la información registrada y su coherencia con la situación económica, transaccional y patrimonial de ARANDA SOFTWARE.

Toda la información contable (registros, libros, documentos) estará disponible para inspecciones, con el fin de asegurar que no se tengan cuentas paralelas o contabilidad duplicada.

Está prohibida la emisión y/o conservación de registros de gastos inexistentes, o de pasivos sin identificación correcta de su objeto, o de transacciones que no contengan un propósito genuino y legítimo, adicional a ello no se destruirán intencionalmente libros contables u otros documentos relevantes antes de lo establecido por la ley.

7.1.21.2 Resolución de conflictos de interés

Los accionistas, administradores, colaboradores, proveedores, contratistas y terceros en general deben mantenerse leales a la empresa, y observar las siguientes conductas, las cuales tienen como objetivo minimizar, manejar o eliminar el posible surgimiento de un conflicto de interés:

- Los colaboradores no podrán tener vínculo familiar con personas que tengan alguna relación laboral directa dentro de la estructura organizacional del área y/o en alguna de las estructuras de los clientes internos con los que trabaja directamente. Lo anterior solo será autorizado si se expone desde el proceso de selección y contratación y se autoriza por parte de la gerencia de la compañía, la autorización deberá quedar registrada mediante correo electrónico.

- Deben evitar cualquier situación en la cual sus propios intereses personales o financieros entren en conflicto con los de la Compañía.

- Deben abstenerse de desarrollar actividades en beneficio propio dentro del contexto del desempeño de sus cargos, en la medida en que éstos entren en conflicto con los intereses de la Compañía.

- Deben abstenerse de explotar, directa o indirectamente, cualquier oportunidad de negocios que sea accesible a la Compañía, en procura de su propio beneficio o de terceros involucrada en actos de soborno o corrupción.

- No se debe realizar la gestión de un servicio para un familiar o un tercero con intereses personales, sin tener aprobación previa del máximo órgano social o de un empleado de alto rango de la compañía.

- No se deben otorgar descuentos o exoneraciones, ni retribuciones excepcionales de cualquier tipo por razones de amistad o parentesco, sin tener aprobación previa del máximo órgano social o de un directivo calificado.

- Los empleados deben abstenerse de aceptar dadivas, regalos, ofrendas obsequios, cortesías, agasajos, atenciones, tratos preferenciales entre otros que puedan comprometer su independencia profesional y la responsabilidad de la empresa. Los administradores y empleados deberán abstenerse de otorgar, en contravención de las disposiciones legales o estatutarias, créditos o descuentos a los accionistas, o a las personas relacionadas con ellos, en condiciones tales que puedan llegar a poner en peligro la solvencia o liquidez de la empresa.

El conflicto de interés derivado de los vínculos anteriormente expuestos será calificado como una falta grave para todos los efectos legales, por comprometer el juicio personal de toma de decisiones de quien ocupa el mayor nivel organizacional. También es considerada como una falta grave para todos los efectos legales, cuando no se declare a tiempo o bien, si como resultado de la relación, se contravienen intereses, políticas o beneficios de la organización.

Notificación de situaciones de conflicto de interés: será obligación esencial que todos los colaboradores notifiquen a gestión humana que tienen un vínculo sentimental, familiar, comercial o accionario que puede representar un conflicto de interés con la compañía o con los terceros vinculados a ella.

El incumplimiento a la obligación previamente descrita constituirá una violación grave a las obligaciones que emanan del contrato, pudiendo el empleador tomar las medidas correspondientes de acuerdo a la normativa legal vigente.

Procedimiento de notificación: las situaciones que pudieren configurar conflicto de interés deberán notificarse a su superior inmediato y al área de Recursos Humanos tan pronto sean percibidas y con antelación a la ejecución de cualquier actuación que pudiera verse afectada por ellas.

Notificación de conflicto de interés con proveedores: para el caso de aquellas personas que notifiquen tener un vínculo sentimental o familiar con terceros (proveedores, personal de entidades gubernamentales con las que tenga relación en el desempeño de sus funciones, etc.), la compañía se reserva el derecho de buscar los servicios de otro proveedor que ofrezca la misma calidad, beneficios y/o costos del actual.

En caso de que se trate de un proveedor clave para la organización o que el terminar la prestación del servicio con él implique un riesgo o desventaja o el servicio contratado sea imprescindible para la continuidad del negocio, se deberá notificar al Oficial de Cumplimiento de Ética y al superior Jerárquico, quienes en conjunto con el área de Gestión Humana deben buscar la transferencia del colaborador para mantener la relación de negocio con el proveedor, o bien, limitar sus funciones para eliminar el conflicto de interés.

Excepciones: cualquier excepción a estos lineamientos debe ser validada por el Oficial de Cumplimiento de Ética y autorizada por el Representante Legal, a través de un escrito en el cual se describa la excepción.

7.1.21.3 Protección de Contractuales

Con el objetivo de prevenir la materialización del soborno, soborno transnacional, la corrupción y otras prácticas corruptas, se deberán suscribir los compromisos en los contratos laborales, acuerdos de seguridad, contratos y registros de conocimiento que firman los empleados, clientes y proveedores respectivamente.

Estos contratos deben estipular el origen de los fondos, su legalidad y/o las sanciones relacionadas con conductas indebidas, así como un plan de acción para desistir del negocio cuando esto pueda perjudicar a ARANDA SOFTWARE. El derecho de terminación de las relaciones laborales o comerciales deben quedar claramente estipuladas en los contratos, formatos de conocimiento y/o acuerdos de nivel de servicio, en caso dado que se identifique que la contraparte incurrió o está ejecutando actos de soborno y/o corrupción o está siendo objeto de investigación formal – preliminar o definitiva – por los actos mencionados anteriormente, por parte de cualquier autoridad local o extranjera.

7.1.21.4 Declaración de empleados expuestos a mayor riesgo

Los empleados consideradores expuestos son aquellos que de acuerdo a la naturaleza de su cargo realicen funciones asociadas a los proveedores y clientes que se encuentran expuestos a mayor riesgo, es por ello que deberán firmar un otro Sí al contrato laboral en donde se dispone la cláusula específica del conocimiento y aceptación del Código de Ética y del Programa de Transparencia y Ética Empresarial. Con ello, el empleado se compromete a cumplir lo establecido en este Programa, siendo así informado sobre las sanciones y consecuencias que se aplican al momento del incumplimiento.

7.1.21.5 Política de Entrega y recibo de regalos y entretenimiento a terceros

Para la compañía es muy importante establecer los lineamientos que determinan una conducta lícita en cuanto a la entrega y recibo de regalos y entretenimiento a terceros, por ello, ARANDA SOFTWARE aprobó la HGF-PL-02-Política de entrega y recibo de regalos y entretenimiento a terceros la cual se realizó socialización a todo el personal.

7.1.21.6 Remuneraciones y pago de comisiones a equipo de ventas.

Las remuneraciones y las comisiones al equipo de ventas han sido establecidas desde la firma de sus contratos laborales y sus incrementos corresponderán a lo exigido por la ley o a lo autorizado por la Presidencia. El ingreso variable por efectos de comisiones debe corresponder a lo autorizado por la presidencia, al igual que los cambios que el mismo esquema sufra en el transcurso del tiempo. La información sobre el esquema de comisiones podrá ser consultadas por el Oficial de cumplimiento de Ética en el área Financiera, las cuales son establecidas desde la definición de la HGF-PL-04 – Política de ventas y la HGF-FT-05 – Matriz de autorizaciones.

7.1.21.7 Gastos de alimentación, hospedaje y viaje

Los pagos de gastos de viaje se realizan conforme a lo establecido en la HGF-PL-03 – Política de Reembolso de Gastos y la HGF-FT-05 – Matriz de autorizaciones. Se deben conservar todos los soportes que permitan determinar el cumplimiento del procedimiento mencionado.

7.1.21.8 Prohibición de soborno y pagos de facilitación

Se prohíbe a los empleados de ARANDA SOFTWARE los actos de ofrecimiento, promesas o pagos; o arreglar que un tercero ofrezca, prometa o pague, sobornos, coimas, comisiones ocultas, regalos lujosos, servicios ilegales, entretenimiento excesivo o algo más de valor a ninguna persona con el propósito de ejercer influencia indebida sobre el receptor; inducir al receptor a violar sus obligaciones; asegurar una ventaja indebida para la Compañía; o premiar al receptor por algún comportamiento en el pasado. Dichas ofertas, promesas y pagos están prohibidos incluso si se hacen los pagos personalmente con dinero propio sin solicitar un reembolso de la Compañía. Tampoco puede recibir ningún pago, regalo o servicio indebido

Igualmente, se prohíbe realizar pagos de facilitación, con los que se busque asegurar o agilizar trámites administrativos o de rutina de alguna autoridad. Además, por ninguna circunstancia se brindarán sobornos por medio de terceros ajenos a ARANDA SOFTWARE, tales como agentes externos, consultores, accionistas, representantes, proveedores u otros intermediarios que actúen en nombre de la compañía.

7.1.21.9 Leyes Antimonopolio / Competencia

Para garantizar un comportamiento de competencia que no genere monopolio ni admita ciertas prácticas consideradas como dañosas para las empresas, a consumidores o ambos, o a quienes

violan los estándares de conducta ética en general. Para ARANDA SOFTWARE es muy importante estar alineado a los requisitos legales vigentes aplicables.

Ningún empleado podrá compartir información comercialmente sensible con competidores sin la aprobación previa de la Presidencia a través de firma de acuerdo de confidencialidad. Los empleados y la Alta Dirección de ARANDA SOFTWARE, y cualquiera que actúe en nombre de la empresa, que crean que han estado involucrados y que tienen conocimiento de una actividad que pueda presentar un problema con la ley de antimonopolio y sobre competencia vigente debe informarlo inmediatamente.

Las siguientes son conductas que la compañía considera inapropiada y prohibida:

- Acordar con un competidor la división o repartición de otra manera del mercado o los clientes.

- Acordar con un competidor el establecimiento de los precios.

- Colaborar o coordinar con un competidor una licitación competitiva.

- Acordar con un competidor boicotear otro negocio.

- Discutir información comercialmente sensible con un competidor.

Ofrecer, dar, prometer, o autorizar dinero o cualquier bien-material (dinero en efectivo, regalos, préstamos, comidas, viajes, alojamiento) a algún funcionario Público Internacional o Nacional, o persona natural o persona jurídica, con el fin de obtener, retener o direccionar negocios a cualquier persona, para obtener una ventaja o beneficio indebido.

7.1.21.10 Contribuciones políticas

ARANDA SOFTWARE no hará donaciones de carácter político, de esta misma manera se establece que las participaciones individuales de los empleados en política nunca conllevarán el uso de fondos, tiempo, equipo, recursos, instalaciones, la marca o el nombre de la compañía.

7.1.21.11 Donaciones

La compañía se encuentra comprometida con el desarrollo y apoyo a la comunidad, por ello ha establecido la HGF-PL-01 – Política de donaciones, en la que dispone los lineamientos para la ejecución de donaciones de manera controlada que permita mantener la debida diligencia al beneficiario final, logrando mantener controlados los riesgos de corrupción, soborno y soborno transnacional.

7.1.21.12 Reporte de Actividades de Soborno Transnacional y Otras Prácticas Corruptas

ARANDA SOFTWARE promueve la integridad y la reputación mediante una conducta ética y lícita, es una de las principales prioridades para proteger los valores y evitar posibles daños a la empresa, por ello es importante que las partes conozcan las infracciones de cumplimiento.

Por lo anterior para ARANDA SOFTWARE, es fundamental que la cultura empresarial permanezca abierta y orientada a sus valores. Llevando a que los líderes de proceso, empleados, proveedores, clientes y otros sectores que observen o tengan conocimiento de la materialización de riesgos tales como el Soborno, Soborno transnacional y Corrupción las comunique y denuncie al interior de la organización o en su defecto a las autoridades competentes.

Utilizar los canales de denuncia de irregularidades de un modo responsable, sin abusar de su uso para dirigir insultos, difamaciones, u otras críticas que perjudiquen a otra persona, sin pruebas incriminatorias.

Los denunciantes solo deberán facilitar aquella información de cuya veracidad estén convencidos.

Canales de atención

Para notificar cualquier incidente de cumplimiento puede ponerse en contacto con el Oficial de Cumplimiento de Ética a través de reportes presenciales, llamadas anónimas (601) 756 3000 – 321 4699008, buzón de sugerencias o al correo oficialdecumplimientoptee@arandasoft.com con la siguiente información:

a. Tipo de incidente.

b. Nombres de las personas implicadas.

c. fecha, hora, y lugar de incidente.

d. Frecuencia del Incidente.

Las denuncias son confidenciales y no tendrá que revelar la identidad si no se desea.

Algunos ejemplos de temas que podrían ser reportados incluyen preocupaciones acerca de:

a) Informes financieros.

b) Controles internos (como fraude).

c) Divulgación pública o retención de registros.

d) Fijación de precios o ley de competencia /asuntos antimonopolio.

e) Corrupción.

f) Pagos u obsequios inapropiados (soborno).

El oficial de cumplimiento de Ética mantiene seguimiento y control de las denuncias presentadas por medio del HRC-FT-02 – Formato control de Denuncias.

7.1.21.13 Informes

Anualmente el Oficial de Cumplimiento de Ética realizará presentación de informes a la Asamblea de accionistas. Este informe se realiza bajo el EMC-FT-07 – Formato de informe oficial de cumplimiento de Ética el cual menciona la evaluación y análisis de la eficiencia y efectividad del Programa de Transparencia y Ética Empresarial y, así mismo, las mejoras respectivas.

7.1.21.14 Divulgación y Capacitación

La elaboración del cronograma semestral y ejecución de divulgación y capacitación del Programa de Ética Empresarial estará a cargo del área de Gestión Humana bajo la orientación y respaldo del Oficial de Cumplimiento de Ética. Dicha programación queda registrada en el formato HAR-FT-03 – cronograma de capacitaciones.

Durante el proceso de inducción en el ingreso de nuevos empleados se incluye todo lo relacionado con el programa de transparencia y ética empresarial, quedando esta como la evidencia de la comunicación del mismo. En cuanto a los empleados antiguos se debe realizar en el proceso de reinducción anual con el fin de promover la cultura de ética. La evidencia de las capacitaciones se hará mediante la generación del formato que se descarga de la herramienta online, todas las actividades de capacitación son evaluadas estos resultados son presentados al Oficial de Cumplimiento de Ética para tomar las medidas en los casos que se consideren necesario.

7.1.21.15 Mecanismos y normas internas de auditoría

El Oficial de Cumplimiento de Ética en el ejercicio de sus funciones podrá programar y ejecutar auditorías anualmente o cada vez que determine necesario para validar el cumplimiento de las disposiciones del presente programa y procedimientos de la compañía, que conlleven a identificar las desviaciones o incumplimientos potenciales. Como evidencia de esta auditoría se genera el formato HRC-FT-03 – Formato lista de chequeo de auditoría, en esta actividad se incluye la verificación total de la implementación y cumplimiento a las política y procedimientos establecidos para el PTEE. En la supervisión por parte del Oficial de Cumplimiento de Ética respecto de la gestión del Riesgo de Corrupción y Soborno Transnacional en las relaciones con Entidades Estatales o en los Negocios o Transacciones nacionales o Internacionales en los que participe ARANDA SOFTWARE. Para este efecto, se realizarán las actividades descritas en el documento HRC-PR-03- procedimiento de eventos de corrupción y soborno transnacional, que le permite al Oficial de Cumplimiento de Ética verificar la eficacia de los procedimientos orientados a la prevención de cualquier acto de Corrupción o soborno.

7.1.21.16 Consecuencias y Sanciones

El incumplimiento del presente programa constituye una violación del contrato laboral (empleados) o comercial (proveedores y contratistas), por lo tanto, se aplicarán las respectivas sanciones que pueden implicar incluso la terminación de la relación laboral o comercial. También se podría incurrir en multas, sanciones administrativas o penales de acuerdo a lo establecido en la Ley 2195 del 18 de enero de 2022 y las que le modifiquen.

Para el caso de empleados, y dependiendo de la gravedad conforme al caso concreto, se aplicarán las medidas a que haya lugar, obrando en concordancia con lo definido en el Código Sustantivo de Trabajo, Reglamento Interno de Trabajo y el Código de Ética. Las sanciones laborales se aplicarán sin perjuicio de las demás sanciones civiles, administrativas y penales existentes en la normatividad vigente que procedan contra los mencionados empleados, administradores y directivos, incluyendo, de manera especial, aquellas relacionadas con la Corrupción y el Soborno Transnacional y las contenidas en el Código Penal colombiano y las normas que lo adicionen o modifiquen.

Es responsabilidad de ARANDA SOFTWARE, verificar que los empleados, administradores y directivos cumplan a cabalidad con las instrucciones impartidas y que cualquier irregularidad relacionada con la Corrupción y el Soborno Transnacional, se ponga de manera inmediata en conocimiento del Oficial de Cumplimiento de Ética.

7.1.21.17 Archivo y Conservación Documental

El numeral 5.1.5.2. del capítulo XIII de la Circular Básica Jurídica, menciona que “los soportes deberán conservarse de acuerdo con lo previsto en el artículo 28 de la Ley 962 de 2005, o la norma que la modifique o sustituya”. Por lo anterior, ARANDA SOFTWARE define que los soportes de las revisiones, evaluaciones y auditorías del PTEE, así como la información de registros de transacciones, debidas diligencias y en general, toda la documentación referente a la implementación y ejecución del PTEE, se deben organizar y conservar como mínimo por diez (10) años, garantizando la integridad, oportunidad, confiabilidad, reserva y disponibilidad de la información dado que dichos soportes pueden ser solicitados por las autoridades competentes.

La documentación del Programa de Transparencia y Ética incluye la Política Antisoborno y Anticorrupción, procedimientos, documentos relacionados con negocios o transacciones internacionales, informes del Oficial de Cumplimiento de Ética, matriz de riesgos, documentación de la divulgación y capacitación, control de las denuncias con sus respectivos soportes, entre otros.

Los responsables de la documentación del Programa de Transparencia y Ética Empresarial al interior de ARANDA SOFTWARE deberán velar por su integridad, confiabilidad, disponibilidad, cumplimiento y confidencialidad, de acuerdo con lo establecido en el documento EMC-CP-01 – Elaboración de documentos y registros.

7.1.21.18 Traducción De Políticas

La documentación del Programa de transparencia y ética empresarial no requiere ser traducidas a otros idiomas ya que las operaciones generadas son a nivel nacional.

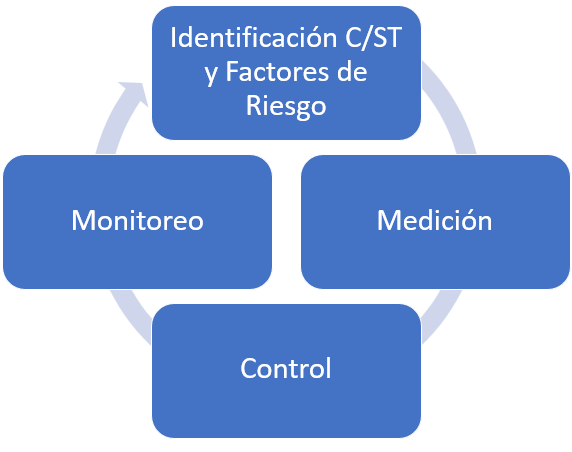

La administración de riesgos se define como el proceso de planear, organizar, dirigir y controlar las actividades relacionadas con la identificación y análisis de los riesgos a que está expuesta la empresa, con el propósito de definir una respuesta apropiada que permita mitigarlos, minimizarlos, retenerlos, transferirlos, compartirlos, asumirlos o en el peor de los casos eliminarlos. Una adecuada gestión de riesgos se refleja en la toma de decisiones asertivas y en minimizar la posible materialización del riesgo, disminuyendo su posibilidad de ocurrencia y/o impacto que contribuyen al cumplimiento de los objetivos de la Sociedad.

Por lo anterior, ARANDA SOFTWARE definió el siguiente esquema de gestión de riesgos de C/ST:

8.1 Etapa de Identificación del Riesgo de C/ST y sus Factores de Riesgo

Esta etapa tiene como principal objetivo identificar los riesgos por cada uno de los factores de riesgo (país, sector económico y terceros).

8.1.3 Políticas para la identificación del Riesgo de C/ST y sus Factores de Riesgo

La identificación de los riesgos será realizada por el Líder de cada proceso de la empresa con la orientación del Oficial de Cumplimiento de Ética. Se debe realizar teniendo en cuenta las fuentes de riesgo, los procesos y los subprocesos.

- La identificación de los riesgos se soporta en la evaluación de los factores de riesgo.

- La identificación de riesgos debe realizarse previamente al lanzamiento de cualquier producto, la modificación de sus características, la incursión en un nuevo mercado, la apertura de operaciones en nuevas jurisdicciones y el lanzamiento o modificación de los canales de distribución.

- El líder de cada proceso es responsable de administrar los riesgos que, en conjunto con el Oficial de Cumplimiento de Ética, sean identificados.

- Se deberá tener como referencia para la identificación de riesgos de C/ST las Tipologías, que se definen como los procesos o métodos adoptados por los corruptos para obtener un beneficio en particular para un tercero o para él mismo.

8.1.4 Metodología para la identificación del Riesgo de C/ST y sus Factores de Riesgo

La identificación debe incluir todos los aspectos de los riesgos, estén o no bajo control de la entidad, teniendo presente que la no identificación de un riesgo real o potencial reduce la efectividad de análisis posteriores y limita la gestión de la organización frente a la administración del riesgo de C/ST.

Para realizar el proceso de identificación de riesgos, se deberá dar cumplimiento a las políticas definidas por la Sociedad en el presente Manual y en los procedimientos establecidos en el documento HRC-PR-01 – Procedimiento de gestión y control del riesgo.

8.2 Etapa de Medición del Riesgo de C/ST

Una vez identificados cada uno de los riesgos de C/ST se debe establecer cuál es su frecuencia de ocurrencia del riesgo inherente frente a cada uno de los factores de riesgo analizando tanto frecuencia de realización como eventos materializados y el impacto en caso de materialización, en los diferentes aspectos analizados (Financiero, Operativo, Legal, Reputacional y Contagio).

8.2.3 Políticas para la medición del Riesgo de C/ST

Las políticas son:

- La medición de los riesgos será realizada por el Líder de cada proceso de la empresa con la orientación del Oficial de Cumplimiento de Ética. Se debe realizar teniendo en cuenta las fuentes de riesgo y las áreas de impacto.

- La identificación de los riesgos se soporta en la evaluación de los factores de riesgo.

- El líder de cada proceso es responsable de administrar los riesgos que, en conjunto con el Oficial de Cumplimiento de Ética, sean calificados.

8.2.4 Metodología para la medición del Riesgo de C/ST

Con el fin de llevar a cabo la medición de los riesgos de C/ST, se establecieron metodologías que permiten tomar las acciones correspondientes frente a la exposición de dichos riesgos.

Para realizar el proceso de medición de riesgos, calificarlos y determinar el perfil de riesgo inherente, se deberá dar cumplimiento a las políticas definidas por la Sociedad en el presente Manual y a los procedimientos establecidos en el documento HRC-PR-01 – Procedimiento de gestión y control del riesgo.

8.3 Etapa de Control del Riesgo de C/ST

Para una adecuada y efectiva administración de los Riesgos de C/ST es fundamental poder determinar, teniendo en cuenta el costo/beneficio, el control que se ajusta de forma adecuada para cada ventana de exposición.

8.3.3 Políticas para la etapa de Control del Riesgo de C/ST

Las políticas son:

- La exposición a los Riesgos de C/ST deben contar con por lo menos un control por cada riesgo identificado en la etapa anterior. De evidenciar riesgos que no sean mitigados por un control, estos casos deberán reportarse a la Asamblea de Accionistas de inmediato.

- Para garantizar el funcionamiento efectivo de los controles, ARANDA SOFTWARE realizará la evaluación de los mismos periódicamente (por lo menos una vez al año), teniendo en cuenta las variables de cobertura y la eficacia del Control. Esta validación está a cargo de los líderes de proceso como responsables directos de su ejecución y mantenimiento bajo el acompañamiento del Oficial de Cumplimiento de Ética.

- Dependiendo de la escala de calificación del control los riesgos podrán disminuir, la probabilidad de ocurrencia y/o impacto, máximo hasta dos niveles de acuerdo con la metodología.

- Una vez aplicados los controles al riesgo inherente, el resultado genera el perfil de riesgo residual el cual no podrá ser superior a la categoría de “Moderado”. De lo contrario se tendrán que generar control(es) adicional(es) que mitiguen el riesgo residual llevándolo a la categoría permitida.

8.3.4 Metodología para la evaluación del Control del Riesgo de C/ST

Con el fin de asegurar que los controles mitiguen adecuadamente los riesgos de C/ST, se requiere establecer metodologías que permitan validar la eficacia del control y tomar las acciones correspondientes frente a la exposición de dichos riesgos.

Para realizar el proceso de medición de riesgos, calificarlos y determinar el perfil de riesgo residual, se deberá dar cumplimiento a las políticas definidas por la Sociedad en el presente Manual y a los procedimientos establecidos en el documento HRC-PR-01 – Procedimiento de gestión y control del riesgo.

8.4 Etapa de Monitoreo del Riesgo de C/ST

El Representante Legal en conjunto con el Oficial de Cumplimiento de Ética deben realizar una supervisión y monitoreo general del Programa de Transparencia y Ética Empresarial validando su cumplimiento efectivo, eficiente y oportuno. Si al realizar estas revisiones encuentra desviaciones o necesidad de reforzar el Programa, se deben adaptar los correctivos y actualizaciones al mismo, cuando las circunstancias lo requieran.

Lo anterior se realizará a través de la revisión de:

- Matriz de riesgos.

- Aplicación de los procedimientos de debida diligencia para los proveedores y contratistas, trabajadores, socios, accionistas, beneficiarios de donativos.

- Presentación de informes del oficial de cumplimiento de Ética a la asamblea.

- Desarrollo de capacitaciones.

- Disponibilidad de los canales de denuncias.

- Control de denuncias.

- Archivo y conservación de la documentación, entre otros.

Con este mismo propósito, el Revisor Fiscal deberá realizar los análisis y evaluaciones correspondientes para reportar a la Asamblea de accionistas los posibles actos de soborno y corrupción que hubieren detectado en el ejercicio de su cargo.

La Oficina de las Naciones Unidas contra la Droga y el Delito –UNODC– y el Departamento de Justicia de los EEUU han establecido las siguientes tipologías (modalidades) de soborno y corrupción, dentro las que se destacan las siguientes:

9.1 Tipologías generales de Soborno Internacional

TRÁFICO DE INFLUENCIAS

El servidor público utiliza su cargo de manera indebida, para presionar el direccionamiento de un proceso precontractual e incidir en la adjudicación de una licitación a favor de un proponente en particular. De esta manera, se afectan gravemente los principios de selección objetiva, transparencia, responsabilidad, igualdad y economía, previstos en el estatuto de contratación pública.

El servidor público se beneficia del pago de comisiones y otro tipo de beneficios que recibe del proponente que fue favorecido en el proceso.

SOLICITUD DE FUNCIONARIOS PÚBLICOS Y PAGO DE SOBORNOS “COIMAS”

Esta modalidad hace referencia a la solicitud de comisiones y a la extorsión a contratistas, por parte de funcionarios públicos, para ignorar los incumplimientos del contrato.

En algunos casos, la solicitud implica el pago, al funcionario público, de comisiones periódicas o la entrega de un porcentaje de las sumas recibidas por las adiciones que se hagan al contrato. Tales agendas se justifican bajo el pretexto de ser indispensables para el cumplimiento óptimo de las obligaciones contractuales, o de que son producto de cambios imprevistos en las condiciones de ejecución del contrato, entre otras razones.

Los funcionarios involucrados estarán dispuestos a obstaculizar los procesos de auditoría que se puedan presentar, con el fin de ocultar el pacto indebido que tienen las partes. Incluso, de ser necesario, compartirán parte de sus “ganancias” con los auditores que demuestren interés por participar en el “negocio”.

OFRECIMIENTO A FUNCIONARIOS PÚBLICOS Y PAGO DE SOBORNOS “COIMAS”

Esta tipología se refiere al pago de “coimas” o sobornos por parte de un proponente/ contratista a funcionarios públicos que favorecieron a un particular en un proceso de licitación y a funcionarios públicos que omitieron su función de control.

El particular acuerda con los funcionarios públicos el pago de un monto específico como recompensa por el direccionamiento del proceso precontractual (a través del amañamiento de los pliegos de condiciones y de la evaluación de las ofertas), dando como resultado su adjudicación a una empresa que no cumple con los requisitos solicitados, violando de manera flagrante los principios de selección objetiva, transparencia e igualdad del estatuto de la contratación pública.

Posteriormente y con el propósito de no ser sancionado por incumplimiento, el particular paga un soborno a un funcionario de un organismo de control para que éste no ejerza su labor. Los servidores públicos corruptos pueden recibir el pago del soborno a nombre de un tercero cercano suyo, en especie con bienes que pueden ser explotados legal y permanentemente o ser renegociados. Igualmente pueden constituir una fiducia de administración y pagos con el fin de realizar pagos periódicamente con los rendimientos producidos con la inversión realizada. El principal objetivo es aprovechar el aparente anonimato que le da el hecho de que sea una sociedad la que hace los pagos.

SUPERVISIÓN E INTERVENTORÍA DESLEAL

Esta tipología hace alusión a la manipulación de la función de interventoría llevada a cabo por particulares, con el interés de beneficiar a un tercero.

De esta forma, la interventoría entorpece, de manera indebida, la ejecución de un contrato. Para ello, hace solicitudes frecuentes e innecesarias o emite conceptos técnicos equivocados, entre otras prácticas, con el fin de presionar el incumplimiento por parte del contratista.

DESCUIDO EN EL EJERCICIO DEL SERVICIO PÚBLICO

Esta modalidad se presenta ante la ausencia de una debida diligencia en la gestión de cobro a empresas particulares, por parte de una entidad pública.

En efecto, los funcionarios hacen caso omiso de sus obligaciones de recaudo, de manera negligente, lo que genera un incremento injustificado en la cartera adeudada a la entidad.

Con dicha omisión, se desconoce el mandato de salvaguardia de los recursos públicos y el interés general.

CONSORCIOS O UNIONES TEMPORALES “DE PAPEL”

Utilización indebida de la figura de consorcios o uniones temporales para contratar con el sector público con el fin de beneficiarse durante la ejecución del contrato. Esta tipología se refiere al pago de “coimas” o sobornos por parte de un proponente/ contratista a funcionarios públicos que favorecieron a un particular en un proceso de licitación y a funcionarios públicos que omitieron su función de control.

El particular crea un esquema societario sin la capacidad patrimonial para contratar, dando como resultado la adjudicación a una empresa que no cumple con los requisitos solicitados, violando de manera flagrante los principios de selección objetiva, transparencia e igualdad del estatuto de la contratación pública. Acude a esquemas fiduciarios para apalancarse en terceros cuyos recursos no tienen origen claro y pueden, a través del esquema, dispersar recursos de anticipos o pagos cuyo destino principal no necesariamente se relaciona con el objeto del contrato.

El fideicomitente beneficiario del anticipo ordena como pago a terceros, salida de recursos para sí mismo o para miembros de la organización corrupta, en pequeños y medianos montos, vía transferencia internacional o diseminada a muchas personas que no necesariamente tienen que ver con el objeto del contrato. Igualmente pueden hacer transferencias o envíos físicos al exterior para pagar desde otra jurisdicción deudas vencidas a favor de una “empresa exportadora local”, (generalmente con dificultades económicas) para de esta forma justificar los recursos.

BENEFICIARIOS “FANTASMAS”

Manipulación y alteración de bases de datos para obtener recursos por personas a las cuales no se les está prestando un servicio. Esta tipología se refiere al desfalco que se hace al Estado en casos en los que se reconoce un pago o transferencia por persona beneficiada por un servicio público, sea éste prestado por instituciones públicas o privadas.

Para tal fin, se “inflan” las cifras de personas atendidas con el fin de apropiarse de manera indebida de recursos públicos. En algunos casos, los particulares que incurren en estas acciones se benefician de bonos adicionales por la atención de un número mínimo determinado de personas, lo que se constituye en un fuerte incentivo para seguir manteniendo “inflada” la cifra.

Una vez el Estado transfiere los recursos, los involucrados extraen los dineros a través de otras acciones ilícitas, como por ejemplo el cobro por prestación de servicios que no se han realizado, la sobrefacturación, etc. Para mantener las apariencias, se manipulan las bases de datos y se entorpece la función de control del servicio en cuestión. Incluso en algunos casos, los funcionarios encargados de realizar las labores de supervisión, vigilancia y control participan del acuerdo y se benefician económicamente con parte de los recursos que son desviados.

Generalmente participan varios servidores públicos y particulares, por lo que los montos objeto de la corrupción se deben repartir dentro de todos los que hacen parte de la estructura criminal corrupta. De igual manera, las organizaciones delictivas de corrupción o propiamente de lavado pueden tratar de justificar el reintegro de divisas generado por la exportación ficticia de servicios, cuya prestación es de difícil cuantificación, dado su carácter intangible.

ADQUISICIONES “A LA LIGERA”